Office Supplies and Office Expenses on Your Business Taxes

:max_bytes(150000):strip_icc()/GettyImages-137552576-1--5754396c3df78c9b46367699.jpg)

Office Supplies and Office Expenses on Your Business Taxes

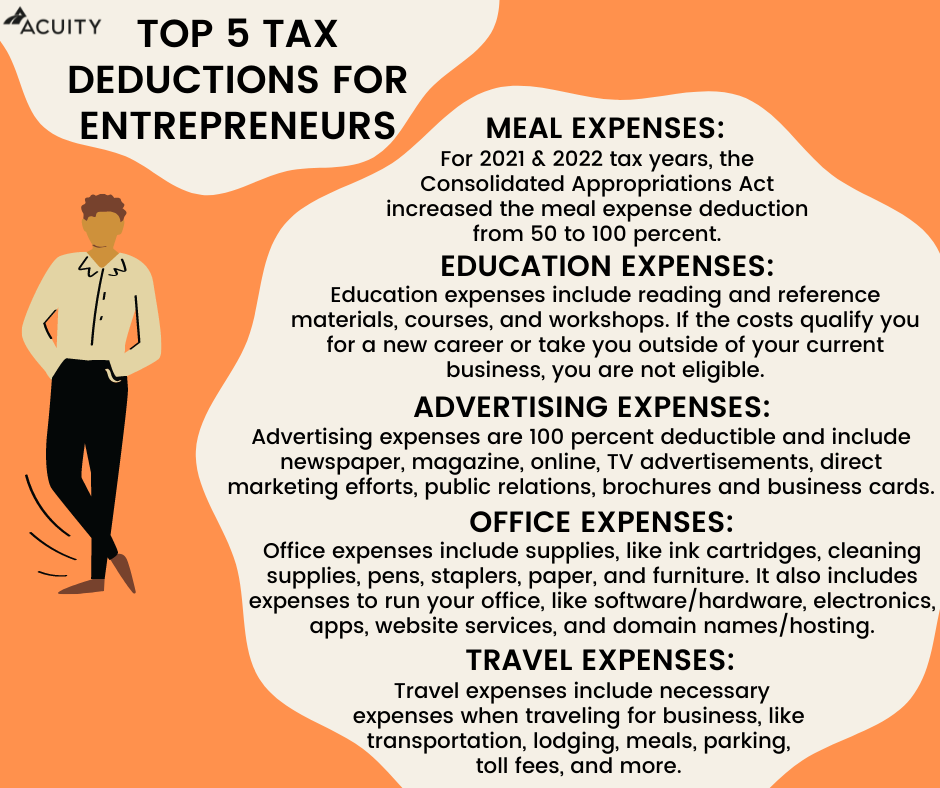

Deducting office supplies and office expenses, the new simpler IRS rule for expensing rather than depreciating, and where to put on your tax return.

Startup Tax Credits & Deductions You Might Be Missing

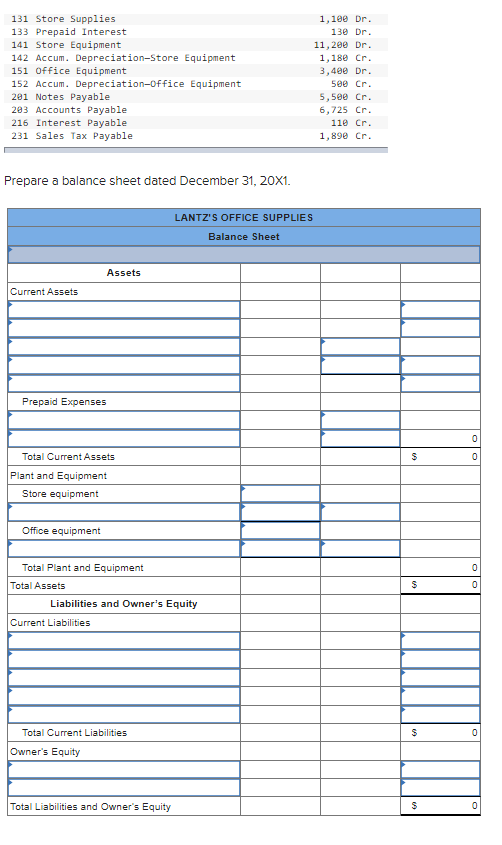

Solved The worksheet of Lantz's Office Supplies contains the

31 Tax Deductions for Shop Owners in 2023

How to Avoid Making a Big Mistake on Your Tax Return — Taking Care of Business

:max_bytes(150000):strip_icc()/general-and-administrative-expenses-resized-9003d17fb75448f186a767e48933bbc5.jpg)

General and Administrative (G&A) Expense: Definition, Examples

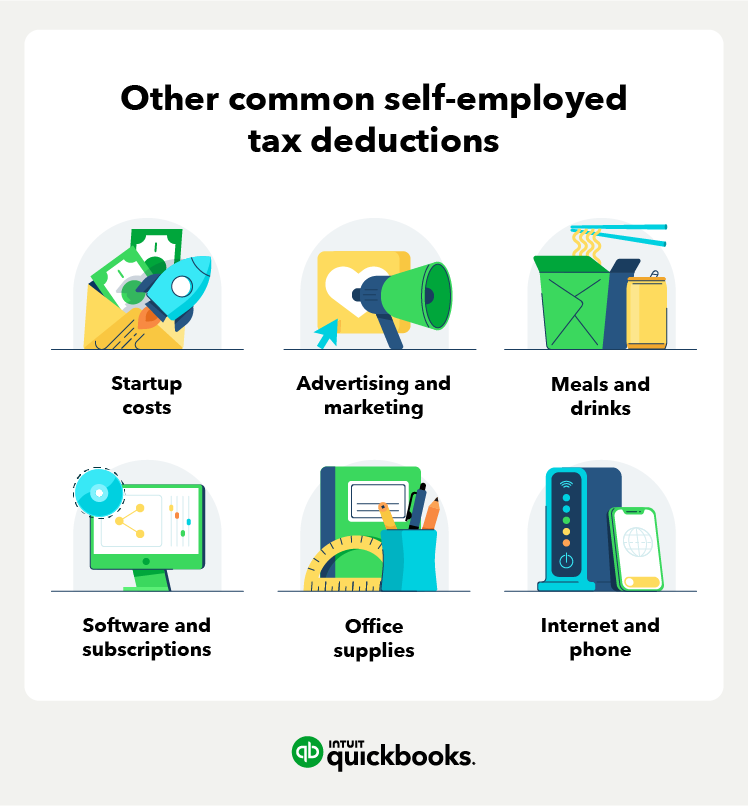

17 self-employed tax deductions to lower your tax bill in 2023 - QuickBooks

Deducting office supplies for your home office: Budget friendly solutions - FasterCapital

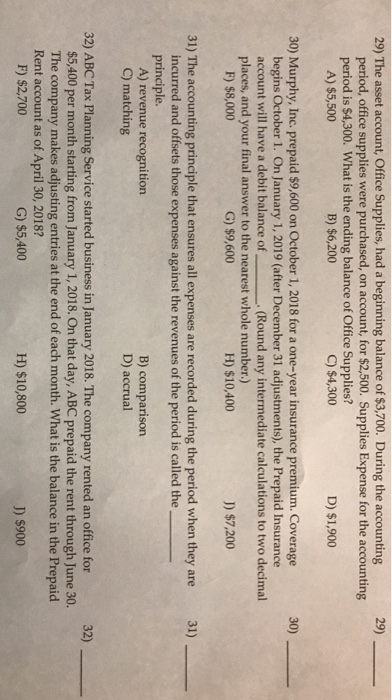

Solved 29) The asset account, Office Supplies, had a

Small Business Expenses & Tax Deductions (2023)

Are Home Office Supplies Tax Deductible?

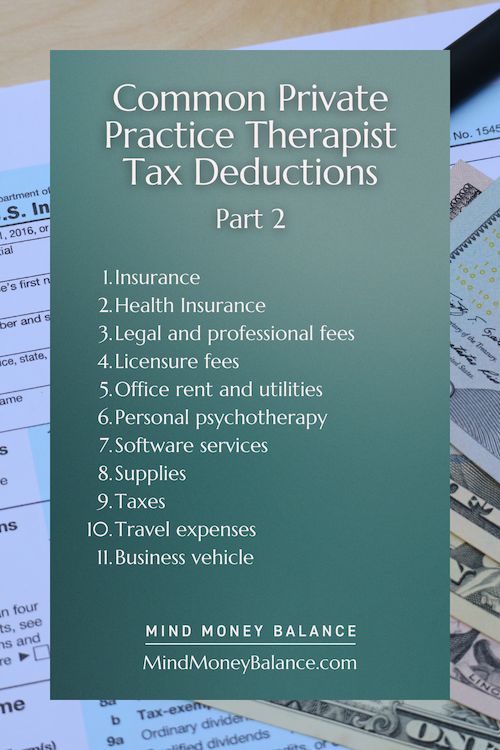

Tax Deductions for Therapists → 15 Write-Offs You Might Have Missed

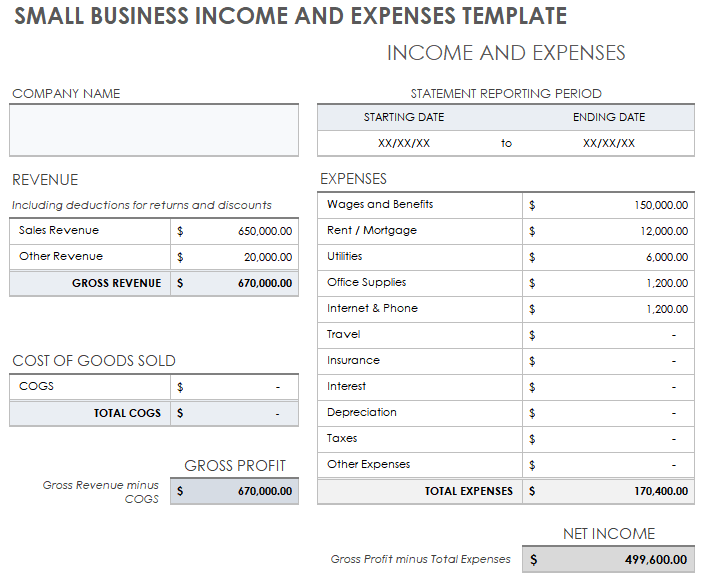

Small Business Income Statement Templates