Retirement Tax Services HSA: Tax-Advantaged Savings Accounts that aren't IRAs

Retirement Tax Services HSA: Tax-Advantaged Savings Accounts that aren't IRAs

CPA Steven Jarvis discusses Health Savings Accounts. The HSA was created in 2003, but it still goes underutilized or misunderstood today.

How to be Tax Savvy in Retirement

Using an HSA As a Retirement Account - AOPA

A health savings account (HSA) can deliver triple tax benefits. Is one right for you? - Azzad Asset Management

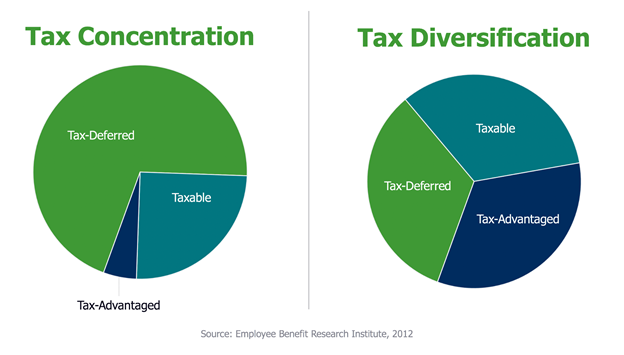

Tax-Advantaged Savings and Recommended Strategies - Millionaire Before 50

Part I: Did Somebody Say HSA? What You Need to Know About the Ultimate Secret Retirement Account — MissFunctional Money

Maximize the Benefits of Your Health Savings Account (HSA) - NARFA

Why I'm Not Using My Health Savings Account to Pay for Medical Expenses

This triple tax-advantaged account might beat your 401(k) plan

Tax-Saving Moves You Can Make Before Year-End

Health savings account (HSA) rules for 2024

:max_bytes(150000):strip_icc()/rules-having-health-savings-account-hsa_final-58180fce30aa4fe8b278b4137e8ccb48.png)

:upscale()/2023/12/04/004/n/1922153/79cca079656e5b7dedfe72.92632787_.webp)