Flexible Spending Account (FSA) Explained

Flexible Spending Account (FSA) Explained

Key points: You won’t owe income taxes on the money you contribute to an FSA. You can use your FSA to pay for your out-of-pocket medical costs. The annual contribution cap is $3,050 for 2023. But it’s not always a good idea to contribute the maximum. Even when you have health insuranc.

Key points: Even when you have health insurance, you know all too well how out-of-pocket medical costs can really add up. U.S. households spent an average of $5,452 on health care in 2021, according to the latest data made available by the U.S. Bureau of Labor Statistics. That total includes about $1,000 for medical supplies […]

Flexible Spending Account An FSA is a program that allows employees to pay for certain medical, dental, vision, and dependent child care related expenses. - ppt download

Set Up Flexible Spending Accounts

Flexible Spending Accounts: Maximizing Your Accident and Health Benefits - FasterCapital

Flexible Spending

What Is a Flexible Spending Account (FSA)? Explained & FAQs, Blog posts

:max_bytes(150000):strip_icc()/Section-125-plan-cafeteria-plan-how-does-it-work_final-8bbf928cabad4e718ccb6d6e4be086d8.png)

How to Use a Limited Purpose FSA (LPFSA)

Flexible Spending Account (FSA) Explained

FSA - Flexible Spending Account, Benefits

What is a FLEX Spending Account? » Silverstein Eye Centers

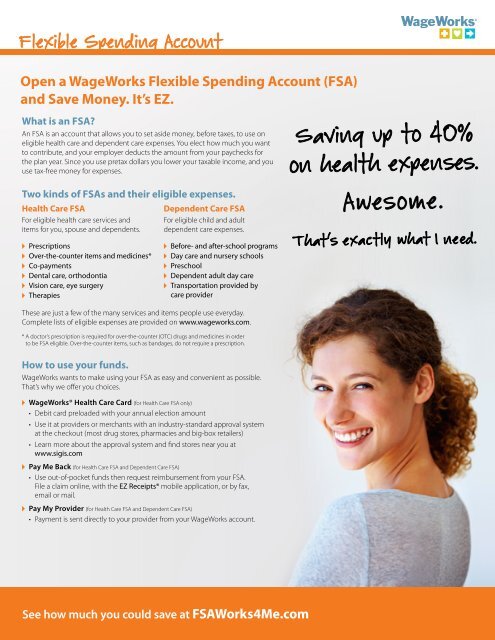

Flexible Spending Account Flyer